SPAC’s have hit a fever pitch moment with the public issuance of Bill Ackman’s Pershing Square Tontine Holding (PSTH/U) yesterday, which is the largest SPAC on record after raising $4.0bn, and trading +6.5% Day 1. Pershing Square intends to invest an additional $1-$3 billion which would place the vehicle’s total value at $5.0-$7.0 billion. This means there is a blank shell company out there with more capital than the total “value” of most private “mature unicorns” they intend to target. Ackman said they are looking to buy a minority stake in a business where shareholders will own ~20%-30% of the company to accelerate growth, deleverage a balance sheet, and provide capital for investors seeking to exit; given the ability to PIPE over 50% you could easily see a $40bn+ transaction. This puts basically every Venture-Backed Company in play.

Target Criteria- In the S1 Pershing Square Tontine identified 4 primary criteria for potential targets:

· Mature Unicorns- privately held companies with a valuation in excess of $1.0bn

· Family Owned Businesses

· Large PE Portfolio Companies

· Companies that otherwise would go public via a traditional IPO

Ackman’s SPAC is the first where the sponsor is not taking any compensation, management fees, incentive fees, or buying discounted stock, etc… which was part of the reason for the positive receptivity.

Over the past 12 months we’ve seen companies like Virgin Galactic (SPCE), DraftKings (DKNG), and Nikola (NKLA) all go public with a SPAC; and as the quality of sponsors continues to improve (e.g., Bill Foley, Bill Ackman, Chamath Palihapitiya, Chinh Chu/Neuberger Berman, etc….) and market receptivity has been strong “blue chip unicorns” are now considering this as a liquidity option which was unfathomable 18–24 months ago, let alone 12–15 years ago during the last “SPAC bubble.”

While SPACs have been around since the 1990s they’ve only recently caught the attention of Silicon Valley & in turn the general public. Below is meant to serve as a high level primer while discussing some of the structural trading considerations to be cognizant of; and some companies we’d love to see seek liquidity via the SPAC route.

What is a SPAC?

A Special Purpose Acquisition Company (SPAC) is a public acquisition vehicle formed by a management sponsor team to raise equity capital via an IPO (in a “blank shell”) with the intent to deploy that capital in a business combination within a finite period of time (typically 2 years). Sponsors will often have relevant industry operating and M&A experience, significant proprietary deal flow, a proven track record of creating shareholder value, and a developed network of investors.

Let’s walk through a hypothetical $500 million SPAC to illustrate the process.

· Sponsor puts up risk capital of ~4–5% of the total raise (in this case $20-$25 million) in the IPO in exchange for 20% of post IPO shares (on paper ~$100mn).

· Gross IPO proceeds are placed in a trust account. Underwriting fees & working capital are funded by the sponsors’ risk capital (the initial $20-$25 million capitalized).

· Sponsors have a predetermined time to identify a target- typically 2 years.

· Once the sponsor identifies a target they look to sign a business combination.

· IPO investors receive their pro rata share of the trust value in exchange for their common shares if:

o They vote to participate in a business combination, or

o The business combination fails to close, insufficient time remains to identify another target and the SPAC is liquidated, or

· If a deal is not consummated sponsors lose their risk capital.

What is the typical structure?

· Sponsor- Initially capitalize the vehicle via founders share for ~4–5% of target raise via purchase of units or warrants.

· Public Investors- Buy units at an IPO of ~$10/unit (typically) and units comprise 1 common share and ½ or 1 full warrant.

o Warrants- These look like 5 year call options with standard terms as follows:

§ $11.50 strike price- (15% premium to Trust Value)

§ Expiry- 5 years from date of business combination (could be as much as 7 years from IPO)

§ Mandatory redemption feature when stock hits a predetermined level; typically $18.

· Trust Account- Gross proceeds are placed in a trust account which invests in Treasuries or Money Market Funds.

o The account is only released upon a successful business combination.

SPAC Advantages: It feels like just yesterday “Direct Listings” were all the rage. If a company is seeking a liquidity event historically they’ve been able to 1) Find a buyer (either strategic or a PE buyout) 2) IPO and more recently (but much less common) 3) Direct List. SPAC’s had been thought of as part of that PE buyout bucket often acting as a “poor man’s” LBO. That’s becoming less & less the case with SPAC’s now acting as a true IPO alternative. Below is a chart showing the comparative advantage of SPAC’s vs. the alternative options:

SPAC Pro / Con List: It’s not to say SPAC”s are an ideal outcome; and if they were the market would’ve coalesced around them much sooner. The below pro / con list is broken down between issuers / investors (and to a lesser extent banks).

Sponsor Benefits:

· Pre-funding validates sponsor with potential targets & speed to closing

· Listing currency created private to public arbitrage opportunity

· Attractive promote

· Speed to Market

· Enhanced Liquidity

Issuer Benefits:

· Time to market (4–6 months) vs. 12–18 months.

· Founders maintain control analogous to IPO / Direct Listing

· The ability to provide forward guidance

· Flexible deal structure / compensation for management.

· Enhanced price discovery

· Avoidance of Principal-Agent Problem (e.g., Do banks care more about optimizing price for their long only / hedge fund clients or issuers?)

o This is something Bill Gurley has talked about extensively on twitter & even posted the question Could IPO’s be replaced by SPAC’s on Quora here.

Public Investor Benefits:

· Shareholder has ability to decide whether or not to participate in business combination

· Public company transparency; given full reporting & disclosure

· Redemption feature creates downside protection

· Can leverage “seasoned” management team’s proprietary deal flow

· Ability to trade & monetize warrants separately.

Cons: There are obviously several cons with the process as well:

· Business combination must overcome dilution of sponsor promote / warrant overhang

· No pre-identification of target allowed

· Costs associated with public company, SEC reporting, governance and investor relations

· Time constraint (2 years in a frothy market may not be enough time)

· Founders lose control over their investor base (vs. IPO)

· Fees- depending upon the negotiating leverage of the company a SPAC deal may be more expensive than an IPO and is often more expensive than a direct listing.

SPAC Lifecycle:

There are several distinct phases of a SPAC with timelines being compressed as competition heats up given the billions on the sidelines in dry powder.

· SPAC Formation- The SPAC sponsor forms a SPAC and looks to raise capital from investors. The size of the SPAC is often predicated upon the sponsor’s track record / ability to sell into the institutional market.

· Yield Phase- Once the IPO occurs the period from IPO until deal announcement is often called the “Yield Phase.” As alluded to above “trust value” or “NAV” is typically $10.00 so they’ll either trade at a slight discount and / or premium to NAV (given the warrants).

o Warrants are the equivalent of 5–7 year call options struck at a 15% premium to NAV . This provides incremental monetization optionality for investors and therefore enhanced “yield” as they are freely tradeable.

o Shareholders here are typically merger arb funds, convertible arb funds, and occasionally quant / yield funds.

· Pre-Deal Rumor- One of the benefits of SPAC’s is the price discovery process. We’ve started to see “leaks” ahead of deals (e.g., Spartan Acquisition Corp (“SPAQ”) / Fisker.) that are seemingly intentional from bankers on both sides (buy side / sell side) to strike a better relative price.

· Hyrbrid Phase- Once a deal is announced it typically takes ~90 days until closing which is driven largely by the proxy process. This is a unique time where shareholders can analyze the prospective fundamentals of the business and look to value shares on a pro-forma basis. However, there is still an embedded “put” option at $10.00/sh as the shareholders can vote the deal down. Key consideration during this time:

o Vote Risk- Most shareholders “vote with their feet” e.g., it’s incredibly rare to see deals voted down in M&A and in SPAC deals. Post GFC there have only been a handful of deals that “failed” due to a vote.

o Rehypothecation- Prime Brokers are unable to rehypothecate shares during this period; which means you cannot short a SPAC from SPAC IPO until deal completion

o Warrants- The warrants typically increase in value and change hands from arbs to speculators.

· Fundamental Phase- Post deal close you will often see a ticker change to the underlying operating company, and the stock begins to trade on fundamental value of both common shares & warrants. There is usually a transition period from the arb / event community to the long-only / long-short community. Historically it’s taken a while to get “Street Coverage” and / or Index Inclusion (given sponsor ownership %’s); but this is slowly changing.

o Warrants are typically systematically underpriced in the early part of the “fundamental phase” as it’s often lost on market participants that they have a 5 year duration from deal close (not SPAC IPO) and that vol should be priced vs. sector comps and not the minimal realized vol from a SPAC.

SPAC Trading Considerations:

There are key considerations investors should be cognizant of when trading SPAC’s at the various points in their lifecycle. In this SPAC Formation / Yield Phase in order to buy a SPAC at a premium to trust value ($10.00/sh) you should look to also purchase the warrants. This provides the investor with the flexibility to offset that premium paid on a potential deal announcement. During this time period arbs / event-funds are the largest shareholders. It’s not uncommon to see them use this as a “cash proxy.” If M&A spreads are tight you’ll see greater participation in SPAC’s (like we’re seeing today). If there are hundreds of billions of dollars of M&A deals outstanding (aka 2016–2018) there’s less capital chasing SPAC’s which often result in them trading at a discount to trust value. While we’ve seen some deals announced in as soon as 3 months (e.g., FVAC), given the fact that SPAC’s are prohibited from pre-identifying a target you typically have a minimum of 6 months and often times 12–24 months until a deal is announced, which is something IPO shareholders should be cognizant of from a holding period / time horizon perspective.

If the Pre-Deal “Rumor” phase occurs, you start to see a transition of the shareholder base from arbs into more speculative event funds & occasionally long/short funds. Historically this period and the “Hybrid Phase” lacked a natural buyer. This allowed for more “patient” event capital (that statement alone is slightly oxymoronic) to buy SPAC’s in the $10.50-$11.25 range (regardless of valuation metrics) and own it prior to the fundamental phase where L/S managers & Long Only investors started to look at the company.

After the success of SPCE & DKNG followed by NKLA, this changed. You have what some people, are referring to as the “Robinhood Mafia” who are loving that risk appetite particularly in “sexy” industries such as Space, Fantasy Sports, EV, etc… They are buying that historical supply from the arbs and serving as the needed demand between arbs / fundamental investors.

VTIQ / NKLA- VectoIQ ownership on Robinhood pre-deal and conversion to NKLA followed by NKLA post-deal. It peaked at ~20,000 investors with 10,000 buying on the deal announcement.

SPAQ- Robinhood traders are starting to become more aggressive and participate in these trades early on. One of the biggest convergence of meme trades this year is the convergence of SPAC’s and EV companies given everyone’s love for TSLA & the desire to find the next TSLA. You had a number of transactions occur over the last few months including VTIQ’s deal with NKLA (announced March 3rd | closed June 3rd), Tortoise Acquisition (SHLL) announced deal with Hyllion (Announced 6/19), Graf Industrial (GRAF) acquisition of Velodyne (rumor 6/25 deal 7/2), and then Spartan Acquisition Corp (SPAQ) acquisition of Fisker (rumor 7/9 announced 7/13). Given the success of the prior deals SPAQ was a popular ticker on SPAC threads, Twitter, Reddit, etc… before deal announcement and ownership keeps going up post deal announcement waiting for the same result as NKLA. NKLA only reached 20,000 shareholders on Robinhood after the deal was announced into approval, SPAQ reached that in the “rumor” stage before a deal was formally announced.

The pushback on SPAC’s has been the fact that they are “distorted from reality” as it pertains to go-forward fundamental valuation of the business. How can NKLA which has $0 of sales be worth $25.0bn+ at its peak?

During this hybrid phase you cannot short a SPAC. The prime brokers are unable to rehypothecate the shares which means it’s a one-sided market. The only “supply” comes from existing shareholders that are long that decide to sell. When this was a void of buyers the stocks typically chopped around in a tight range with limited volatility. Now that you have this Robinhood (which is representative of all “active retail”) contingent buying that puts significant upward pressure on shares during this “hybrid” period.

As the deal gets approved & enters the fundamental phase there is often another transition of the shareholder base from event funds to long only and long/short funds. For the first several months it is often still difficult to short stock as the borrow market slowly starts to develop. At this point warrants are typically systematically underpriced as you have all the IPO buyers / Yield Phase buyers that are selling those down and are relatively price agnostic; definitely not pricing these as 5 year options. These become attractive ways to get long the underlying if you’re bullish intermediate to longer-term.

SPAC Data:

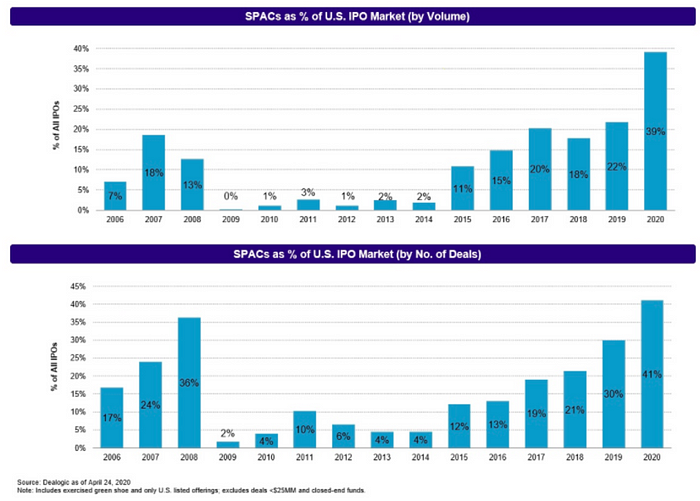

There has been more than $12.0 billion raised this year well on track to surpass 2019’s record total of $13.5 billion. The below chart from Mizhuo is as of April 24th. As you can see the last time we saw more deals with comparable volume was 2007. In ’07 there was real adverse selection bias. SPAC sponsorship was usually the vehicle of choice for Tier II / Tier III PE funds used to make money for guaranteed fees. They were also LBO replacements with high leverage, a change of management, and large sponsor promotes.

The percentage of SPAC’s that are able to complete a successful business combination has been on an uptrend in recent years which is largely a result of a confluence of factors including: improved sponsor pedigree, reducing the dilutive overhang (e.g., less warrants in SPAC units), more “reasonable” sponsor economics, and decoupling of shareholder vote & redemption election. The below chart is from EarlyBird Capital one of the top advisors in the space:

SPAC’s are now making up a meaningful percentage of the IPO market as it pertains to both dollars raised & number of deals; and the pipeline is growing at a faster rate. As of 4/24 Mizhuo showed SPAC’s representing ~39% of the IPO market by volume & 41% by # of deals. These numbers have trended higher over June / July where we’ve seen an acceleration of SPAC issuance.

Why Now?

Why has this all come to a head over the last 6+ months when structural changes to SPAC 1.0 were made years ago? We believe it’s the confluence of a number of factors including:

· Improved Sponsors / Economics- As you’ve had more sophisticated sponsors come to market that are using this vehicle as an opportunity to have capital to deploy to make an acquisition / take a minority stake in an attractive business the historical “egregious” economics of sponsors have been alleviated somewhat; epitomized by Ackman’s decision to not take any compensation, management fees, or incentive fee. If other high quality sponsors have the optionality to raise 10 figures, when active management continues to see outflows they’ll happily given away management fees on the front-end. This has led to enhanced institutional credibility leading to a wider level of participation.

· Perception is Reality/ Historical Precedent- Prior to Virgin Galactic / DraftKings deal there was a lack of historical precedent of a venture-backed company that could have IPO’ed choosing the SPAC path. As Ackman, Foley & Chamath raise larger vehicles & have executed successful transactions (in Foley / Chamath’s case) this starts to lose the historical negative stigma of the liquidity option of “last resort” that SPAC’s had throughout the mid-2000’s and even as recent as the last few years. We think you’ll see a “blue chip unicorn” go public this route in the next couple of months.

· “Broken IPO” Market- The revolt from SV vs. existing IPO’s is palatable. Companies like Slack / Spotify chose to circumvent the process & direct list. Airbnb was reportedly considering a direct listing prior to COVID-19. Those high profile names that have gone the traditional route have seen significant Day 1 pops (e.g., NCNO +195%, API +153%, LMND +140%, JAMF +50%). NCNO was the biggest one-day pop for a US IPO since August of 2000 (and including foreign issuers was second over that period only behind BIDU). This has shined a light on the “principal-agent” problem bankers have and the inefficiency involved in the process of determining a “clearing price.”

· Performance / “Robinhood Mafia”- Historically SPAC’s have lacked liquidity in that “hybrid phase” post deal announcement / pre-deal closure with the lack of a logical buyer outside the occasional event fund or L/S fund with a more opportunistic and longer-term mandate (everyone says they are long-term, few investors are). Given the performance of names like SPCE / DKNG / NKLA etc… retail has been that natural bidder. Coupled with the technical dynamics explained above (e.g., no shorting due to inability to rehypothecate shares), strong price performance has led to more copy cats looking to emulate the types of targets that “have worked.”

· Valuation “Arbitrage”- If there’s anything 2018–2019 showed us, was that many late stage private companies got ahead of where they would be in public markets from a valuation perspective with companies like UBER / LYFT failing to reach the highs seen privately, and of course the WeWork debacle never getting out the door. DTC brands like CSPR getting cut by more than half. Compare those to something like NKLA which is trading at a $13.0bn market cap (with $0 in sales), or DKNG at $13.4bn (vs. ‘19A revenue of $431.8 / $540mn in ‘20E / $700mn in ‘21E while being EBITDA negative), and SPCE trading at a $5.75 billion market cap. For late stage companies that might have issues growing into their valuation (e.g., Coinbase) SPAC becomes a way to “bail out” late stage investors while not hurting earlier stage / common shareholders. Due to the time period in which it takes float to normalize and a true short market to mature companies may have 9–12 months to start to execute prior to having a true “two-sided” marketplace (e.g., NKLA borrow is still incredibly expensive & tough to come by).

· Conversion of Preference Stack- For those Venture Backed companies with a significant “preference stack” a SPAC transaction constitutes a liquidity event which leads to conversion to common stock & a clearance of that; to the benefit of employees and in some cases early stage investors.

· Lack of Public Companies- While this data is a bit dated Credit Suisse had a great report out in 2016 showing the shrinking public market investable universe with the # of listed companies in 2016 less than those in 1976, despite having trillions more in investable assets. So there’s more money chasing less opportunity leading to greater interest in those companies when they come to market.

· 0% Interest Rate World / Lack of M&A- The largest buyers of SPAC IPO’s (during the yield phase) are typically arb funds / event funds. In a 0% interest rate world there are few options to “park cash.” Given the macro uncertainty around COVID-19 we’ve seen a lack of large scale M&A, and even smaller tuck-in M&A for that matter which has left a lot of “dry powder” for arb funds looking for a home.

Structural or Cyclical?

It’s still early to have strong conviction one way or the other on whether or not this SPAC trend is structural or cyclical. We’ve seen enough SPAC “mini-cycles” now to know when they come, they come in waves, as bankers of all shapes & sizes pound the phone for both sponsors & targets to explore the SPAC path given the time to market, and yet still healthy fee schedule. As SV looks for alternatives to the bank-led IPO SPAC’s structured such as Ackman’s start to more closely align investors & companies for their inaugural liquidity event. The biggest question comes if a private company wants to have that “anchor investor” to start but if there is philosophical alignment around the go-forward direction of the business, all of which can be discussed pre-deal it’s nice to have a committed equity partner. At the right size / profitability they will also (eventually) be eligible for index inclusion which will diversify that investor base.

We wouldn’t be surprised to see some more structural modifications as it pertains to incentive fees, promotes, and warrant overhang. If there’s one thing bankers are good at, its financial engineering, and you can be sure all of the bulge bracket banks are playing with different SPAC structures to optimize for these late stage private companies while the window remains open.

What We Want to See?

We’re always partial to the FinTech sector amongst venture-backed companies so we created a “wish list” of deals we’d like to see happen as SPAC transactions. These are deals we’d love to see happen for a variety of reasons; not suggesting they will or should occur nor do we have any information about any of the below.

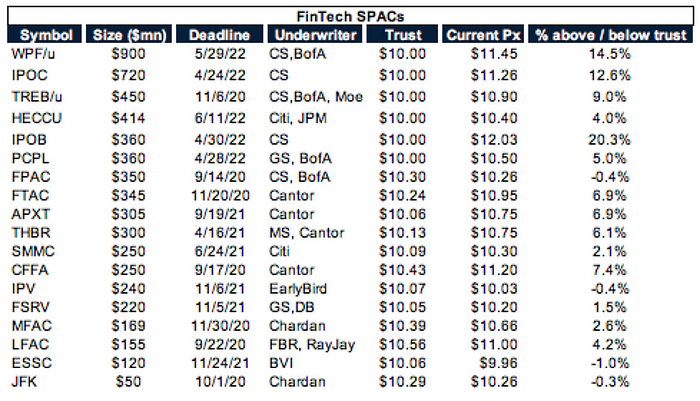

FinTech: There’s currently ~$6.0bn of “FinTech” SPAC mandates outstanding which could lead to $60.0bn + in M&A value.

· Robinhood Go Public via a SPAC- This would be one of the largest convergence of meme trades of the year; if Robinhood traders were bidding up the future Robinhood stock in the form of a SPAC. Outside of a “direct listing” or “IPO” where the users on the platform had a certain allocation it would be one of the most democratic ways to disperse ownership in line with their ethos of “Investing for Everyone”

· Coinbase SPAC- Tiger led a $300 million Series E round in October of ’18 at a $8.05bn valuation. Rumor has it they did $700mn in revenue in 2018 and $500mn in 2019 which is nowhere close to justifying an $8.0bn valuation (as those were most likely off the 2017 peak). Given increasing competition across every business line, it’s tough to see the institutional long only community get excited about Coinbase. But if Space, Gambling, and EV have become trends the Robinhood Mafia wants to back; you’d have to imagine Crypto would fall into that bucket as well. Could be the most eloquent exit & Chamath is familiar with the key players. IPOC would be able to do the deal with a little extra help from PIPE friends.

· SoFi- SoFi raised ~$900mn at a $5.75 billion valuation earlier this year; they have filed for a national bank charter with the OCC (in Utah) and have flirted with going public over the past two years. Not sure how much SoftBank’s ownership position hurts them in the charter process as it pertains to CFIUS approval (remember it took Fortress 12+ months to get through that with SoftBank and they needed to waive “day-to-day” operational control). A SPAC deal would allow them to reconstitute the ownership % / give them a public currency to bolster the balance sheet. Given Bill Foley’s experience with FNF, FIS, BKI, and FGL coupled with his M&A background he could be a perfect partner to have with SoFi given the recent acquisitions (e.g., Galileo / 8 securities). WPF/u has more than enough capital to pull this off.

· Marqeta- Marqeta raised $150mn in May at a $4.3 billion post-money valuation in a Series E. Given their focus on card issuing / payment processing this is truly in Foley’s sweet spot. Noto / Foley might have too much ego in the same board room but Jason Gardner & him would likely be more synergistic. Similar to SoFi WPF has plenty of capital for this business; and while we have no clue what the #s look like, given comps / their reach it’s probably the more attractive of the two to take public.

· Figure- Mike Cagney always likes to do things a bit different. He had told investors he was aiming for a late 2020 / early 2021 IPO of Figure, the business he started in 2018. We wouldn’t be surprised if he was motivated to beat SoFi out of the gate. He wouldn’t attract a “top quality” sponsor given the one-off nature of the HELOC’s they are currently originating, but given his name and the convergence of financial services & DLT it would be a fun one to see.

· Stripe- Stripe last raised $850mn at a $36.0bn valuation earlier this year. It has all the making of an Ackman business and given the $4-$7bn in PSTH, as long as they get the proper PIPE commitment they can pull it off at ~$40-$50bn+. There would be no better way to cap off this SPAC mini-cycle with the largest SPAC, being part of the one of the largest initial liquidity events of all time. The company was founded in 2009 and you’re likely seeing early employees run into some liquidity issues + options struck over the past 3–5 years as they “institutionalized management” needing to find a path for liquidity. The timing could just potentially work out.

Other target’s that could be in play:

Whether or not you think this SPAC trend is structural or cyclical with >$20.0bn of dry powder on the sidelines we’re going to see a number of deals over the coming 6–12 months. With some slight modifications around economics (some of which are being done voluntarily by higher quality sponsors) we think an exit to a SPAC is a truly viable alternative to an IPO / Direct Listing, for venture backed companies. While COVID-19 has seemingly been a time machine for the world, capital markets have not been immune showing their fastest pace of innovation in decades.