Backdrop:

The S&P 500 closed down 7.6% today the worst day since the depths of the financial crisis in December 2008, (triggering a circuit breaker for the first time in 23 years), the yield on the 10-year note dropped below 0.5% for the first time ever, the 30-year breached 1.0%, bringing the whole US yield curve below 1% for the first time, and oil sold off ~20%. The driver? The headlines focused on Saudi Arabia’s’ decision over the weekend to start a price war, as tensions continue to escalate with Russia, sent oil prices down by the most since the Gulf War in January ’91; coupled with renewed and deeper concerns over COVID-19, and the global economic ramifications. The energy sector represents the greatest percentage of high yield borrowers in the US (~11% of the benchmark index) and there are worries about contagion risks triggering a run of defaults (especially considering bank exposures). Others are focused on the increased incidence of COVID-19, and the global economic ramifications, and the virus serving as the catalyst for what some believe is a much needed correction in risk assets that were propped up by artificially lowered interest rates suppressed by global central banks over the better part of the past decade.

When talking about Bitcoin and the advent of the cryptocurrency market we like to say “Quantitative Easing turned your savings account into your checking account, the bond market into your savings account, the equity market into the bond market, the venture market into the equity market, and created the crypto market to become the venture market.” We’ve had a decade + of easy monetary policy globally with interest rates zero bound (and now~70%+ of sovereign credit negatively yielding totaling ~$11 trillion) pushing investors out the risk curve in search of yield + return. This was most certainly needed in the depths of the Great Financial Crisis, and has worked to dampen any interim macro volatility since; including the Flash Crash in 2010, the European Sovereign Debt Crisis in 2011, the US Debt Downgrade in 2011, Government Shutdowns, Populist Elections / Votes (Brexit / Trump), Plunge Protection Team, Trade Wars, threats of actual war, etc… Josh Brown and the team at Riholtz Wealth Management have kept this “Reasons to Sell” chart updated which has done a good job of outlining market shocks, resiliency, and the total return over that time period.

So when the market sells off, just fire up the printing presses, lower rates, watch risk assets get bid, and get through this too right? Famous last words but this time it’s different. On Tuesday March 3rd, the Fed slashed interest rates by half a percentage point, which marked the first unscheduled emergency rate cut since 2008, and it also marked the biggest one-time cut since then. Fed Chairman Jerome Powell said, “We saw the risk to the outlook to the economy and chose to act,” Powell said, adding that the financial markets are functioning normally, the economy continues to perform well, and that he expects the United States to fully recover after the outbreak ends.”

The markets aren’t necessarily reacting to the number of people getting sick or dying, but the measures people are going through to avoid it. As countries like Italy are under lockdown, travel restrictions are imposed, states are declaring emergencies, large gatherings / festivals are cancelled, schools are closing, companies are enforcing work from home policies, and curtailing travel, and sporting events are being cancelled, does a 50bp rate cut alleviate this?

While some are calling for further rate cuts, MMT, and even negative rates (the market is pricing in a ~15% probability of negative rates by July); we believe monetary policy will fall short in alleviating any economic fallout from COVID-19. The travel and tourism industry represents ~10.5% of global GDP; this will be significantly impaired no matter the coordination of global monetary policy. The energy sector represents ~8% of global GDP and will almost undoubtedly see a wave of bankruptcies, and layoffs given the fallout from OPEC. In the US, small businesses contribute ~44% of US economic activity, and will be disproportionately impacted given consumer aversion to leaving the house over risk of contagion. To be clear these economic impacts should be temporary in nature, but acute nonetheless.

In our view any response should stem from fiscal policy initiatives to truly combat the effects of this. Larry Kudlow, President Trump’s chief economic advisor told CNBC he doesn’t want to “panic on policy measures” and “would prefer a targeted approach, a rather micro approach,” Kudlow said. “Let’s think about individuals who might lose paychecks because they have to stay home if they get the virus. Let’s think about small businesses that might get hurt by this.” He suggested they might look at sectors such as airlines in order to be both targeted & timely in their response; while noting the administration is weighing incremental data points as they come in.

To understand the potential economic impacts of COVID-19 requires an understanding of behavioral finance, and the psychology of bubbles and human emotion. When you look at bubbles and their subsequent burst you need to be able to try to anticipate human behavior, and extrapolate the present to think of potential future outcomes.

COVID-19 Timeline- I’ll leave most Coronavirus analysis to the experts (e.g. CDC) but here’s what we know from a timeline perspective:

· 12/31/19- China alerted WHO to several cases of unusual pneumonia in Wuhan

· 1/7/20- Officials identified a new virus named 2019-nCOV which is part of the coronavirus family (which includes SARS and the common cold).

· 1/11/20- China announced its first death from the virus

· 1/13/20- WHO reported the a case in Thailand, the first outside of China

· 1/16/20- Japan’s health ministry reported a confirmed case

· 1/20/20- The first case of coronavirus in the US was a patient in Washington State who had returned 5 days prior from Wuhan, China.

· 1/30/20- The International Health Regulations Emergency Committee of the World Health Organization declared the outbreak a “public health emergency of international concerns” (PHEIC).

· 2/2/20- The first death outside of China was reported in the Philippines

· 2/11/20- The WHO announced the new coronavirus would be called COVID-19

· 2/20/20- South Korea reported its first death from the coronavirus

· 2/21/20- In Italy, the region of Lombardy reported the first local transmission of the virus with three new cases, bringing the total in the country to six infections.

· 2/22/20- South Korea saw its largest spike in a single day with 229 new cases of the virus. Italy reported its first two deaths, while Iran confirmed a 5th death

· 2/29/20- The US reported its first death.

o South Korea report its highest daily number of confirmed cases yet, 813 bringing the country’s total to 3,150 with 17 deaths.

· 3/1/20- First coronavirus confirmed in NYC

· 3/3/20- The US Fed cut rates by 0.5% for the first time since 2008

o Italy announced the death total reached 77

· 3/4/20- First US death outside of Washington State

· 3/6/20- First US coronavirus death outside the West Coast

· 3/7/20- The coronavirus had killed nearly 3,500 people and infected another 102,000 people across more than 90 countries

The number of confirmed coronavirus cases has exceeded 111,000 with 3,800 fatalities globally.

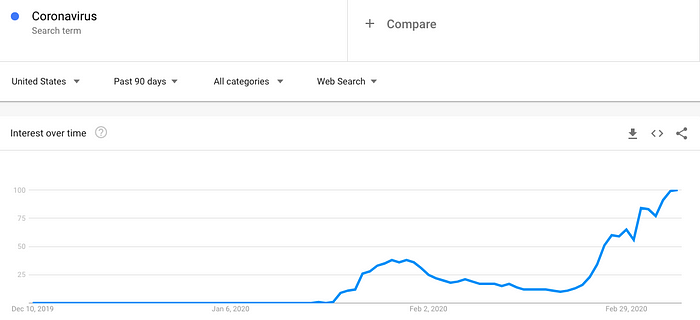

Despite the ~1-month head start the US was slow to react to threats of COVID-19 with the administration and parts of the media latching onto the logic that it was much less deadly than the common flu in terms of aggregate numbers. While there was a slight uptick in interest at the end of January as we had the first confirmed cases in the US, interest didn’t really pick up until this last week. We’ve now seen the media lean in full tilt with a significantly increased incidence of reporting versus prior outbreaks such as Swine Flu, “Zika”, and “SARS.” Hat tip to Eric Balchunas for pointing this out; but we verified by comparing Bloomberg news stories of “Coronavirus” vs. the last three pandemics and it’s not even close in terms of peak coverage (coronavirus is the white line).

We’ve seen people with varying degrees of professional backgrounds weigh in on the contagion effect, analyzing the spread of previous pandemics as well as producing scenario analysis (and defer to the experts here). One viral tweet from Liz Specht, Associate Director of Science & Technology at The Good Food Institute, highlighted the risk of systemic healthcare failure given the fact that there are ~1mn hospital beds in the US, and at an given point in time ~65% of those beds are occupied with ~330K beds available nationwide. Juliette Declercq ran through a comparable analysis on the latest edition of Macro Voices which is also worth a listen.

To anticipate future human behavior, imagine a scenario in which individuals have been quarantined from school & work for a period of two weeks, the head of household is diagnosed with COVID-19, and is denied access to a local hospital because there aren’t enough beds. Do you think the reaction is to buy equities because the Fed cut rates? This has real world ramifications that we don’t want to mitigate but are beyond the scope of this post.

What are the ramifications for risk assets? Where do we go from here? And why does this matter?

Equity Market

Since the equity market high on 2/19 the S&P is off ~18.9% from the close and ~19.2% from the intraday high. Consumer Staples is the only industry not off >10%+ from the highs given the defensive tilt; and some support by the largest weight names (e.g., COST / WMT). We’re seeing a demand decline brought by the virus which has ramifications on earnings estimates, coupled with deflationary pressures from the move in oil, all leading to calls for “further easing.” We’re also seeing CEO departures at a cycle high; which rarely happens at the bottom.

The consensus ‘20E / ‘21E bottom up earnings estimates for the S&P 500 is ~$172.50 / $192.50 which puts it at ~15.9x ‘20E / 14.3x ‘21E vs. a 5-year / 10-year average of ~19.9x / 17.9x respectively. When looking at the equity risk premium the market also looks “cheap” versus recent averages given the move lower in rates (the S&P dividend yield is also greater than that of the 10-year at present which only happened once during ‘08).

We’d be naïve to think that S&P earnings estimates for 2020 don’t need to be cut due to the real economic impacts of the virus. The severity and magnitude of the cuts will be predicated in part upon predicting human behavior but for draconic sake let’s assume there’s a 25% cut to ‘19A EPS (would be the third biggest drop YoY over the past 60 years) which would put it at ~$122.25 (vs. $163A) which depending upon the multiple could see an incremental 25%+ downside from current levels.

Former GS CEO Lloyd Blankfein tweeted today that, “Fear can take mkt lower, but expect quick recovery when health threat recedes. Esp in US, underlying economy strong, banks well-capped, system not too leveraged. Unlike ’08, will avoid systemic damage that cud take years to work thru. Obviously, not ignoring tragic human toll.” We tend to agree that the economic fundamentals in the US are on a strong footing, any impact from the virus should be temporary in nature, and we’d be surprised to see the market trading at a trough multiple on trough earnings.

In times like this as opposed to passively allocating to broader market indices (which we’re in favor of for everyone that isn’t actively monitoring the market or “buying what they know”) we like to “hide” in high quality single names we want to own through different market cycles. We have a list of ~50 names that we actively monitor and a shorter list of 9 names we’re looking to add to when they hit certain levels outlines below. While we expect this to continue to get worse before it gets better as we reach peak COVID-19 concerns once we roll out more robust testing over the next 2–3 weeks running into significant pressure on our healthcare system during April; the below names are at price points where we’d be looking to build positions.

We’re happy to go into our thesis on any of the above names but most are self-explanatory and in-line with our broader FinTech / Sports thesis.

Venture Market

The Venture market is supposed to align long term thinking / planning on behalf of both investors and founders. Yet when there’s volatility in the public markets it almost always manifests itself in venture as well. Sequoia published an excellent blog post entitled Coronavirus: The Black Swan of 2020 where they highlight a series of challenges facing their companies including:

· Drop in business activity

· Supply chain disruptions

· Curtailment of travel & canceled meetings

They highlight that it could take several quarters before we can be confident that the virus has been contained and they suggest their companies focus on:

· Cash Runway

· Prospects of fundraising challenges

· Sales Forecast Adjustments

· Marketing Value

· Headcount Evaluation

· Capital Spending analysis.

This was a follow up to a well circulated deck they sent along to their portfolio companies in 2008 RIP Good Times. Our favorite slide was an email to their portfolio CEO’s where they mentioned raising funding as soon as possible, pursuing M&A opportunities, realistic valuations, the VC community will start exercising their leverage. These principals all hold true today.

We often guilty of using sports analogies and preach to companies that one of the things always in their control is the expense side of the equation; this is equivalent to team defense. As the saying goes defense wins championships and controlling cash is the equivalent of championship-caliber defense. In times of economic uncertainty, the importance of defense is even more elevated.

The Venture industry is more flush with cash than in previous economic downturns, but the cadence of capital deployment, and size of rounds are also elevated. We would expect to see a slowdown and for VC’s to look to rein in valuations that have elevated alongside the balance of risk assets.

We often refer to “Series B” as the orphan stage; often too early for growth but too expensive / not early enough for Series A capital to believe the “dream.” We think companies at this point in the lifecycle will disproportionately struggle as will the sheer number of seed stage companies. Those companies that have found product market fit should find ample capital for growth stage funding although valuations need to re-rate lower.

Bitcoin:

How does all this impact downstream risk? Bitcoin is interesting in this context. Gold has broken out to ATH denominated in a number of different fiat currencies. The virus could be accelerating the move away from physical paper money (China & South Korea are literally burning cash to stem the spread of COVID-19). While further easing and debasement of fiat currencies all are part of the macro narrative for BTC this is its first real test as a “macro asset” as opposed to purely a speculative risk on asset at the outer edge of the risk curve. Over this period BTC has drawn down ~22% only slightly underperforming the S&P during that time period which is notable given its outperformance YTD. This comes ~2 months before the halving as the issuance curve is cut in half for the first time in four years, coupled with what seems to be some green-shoots of constructive legislation globally in places like South Korea and India where demand has been strong at various points in time over BTC’s history; despite an adversarial legislative relationship at times.

Bitcoin is dealing with two polarizing forces as the theoretical macro pitch is as strong as it’s ever been, while those that own it view it as a higher volatility risk asset whose correlation trended towards 1 during period of macro volatility and risk needed to be cut accordingly.

On balance we remain incredibly constructive but tactically speaking if the next 10–15% in equity markets is lower we’d be hard pressed to see a scenario where BTC is higher.

Bottom Line:

Expect things to get worse before they get better. If we look at the Spanish Flu as a worst case scenario the virus infected ~500mn people, killing 20–50mn. While the pandemic lasted for two years the majority of the deaths were packed into three months in the fall of 1918. In March of 1918 it first appeared with all the hallmark signs of a season flu. As US troops deployed for the war effort in Europe, they carried the Spanish flu with them. Throughout April and May of 1918, the virus spread through England, France, Spain and Italy. This first wave of the virus wasn’t particularly deadly, with symptoms like high fever and malaise usually lasting only three days, and mortality rates were similar to seasonal flu. Cases dropped off significantly in the summer of 1918 and there were thoughts that it ran its course. According to the History Channel, “From September through November of 1918, the death rate from the Spanish flu skyrocketed. In the United States alone, 195,000 Americans died from the Spanish flu in just the month of October. And unlike a normal seasonal flu, which mostly claims victims among the very young and very old, the second wave of the Spanish flu exhibited what’s called a “W curve” — high numbers of deaths among the young and old, but also a huge spike in the middle composed of otherwise healthy 25- to 35-year-olds in the prime of their life.” Over the past ~102 years we’ve seen significant advancements in medicine and are infinitely better prepared to handle a pandemic then we were back then. That said history rhymes and there are already talks of a mutation which could set up for an interesting fall.

As the US increases the number of tests available the confirmed cases and unfortunately fatalities will sky rocket. We’ll see disruption of day to day lives with companies implementing work-from-home policies, schools shutting down, sports events continued to be cancelled, and ultimately real strain on the healthcare system. We’ll likely see some combination of global coordination from a monetary policy perspective, coupled with nation specific fiscal policy responses. Unfortunately, this won’t do much to quell concerns in the near term or stimulate near term economic demand.

Once we are able to control the virus, we would expect to see a sharp snapback in economic activity, hopefully stimulated by conducive fiscal & monetary policy. Given the fact that the timing of the virus is unknown we are sticking to the status quo and looking to invest in high quality companies on both the public and private side while being extra disciplined as it pertains to price paid, and focusing on management teams that are good stewards of capital.